This is the price of oil since 2006:

One of these drops is easy to explain: the financial crisis, circa 2008, which devastated the economy. With no material threat of growth, oil prices collapsed from $125+/barrel to about $35.

But then the price rebounded to the $80 - $100 range. Why? Not sure. Why did it crater again around 2014? The easy explanation is fracking, and I could tell a convincing story that fracking is why the price of oil is $55, not $105.

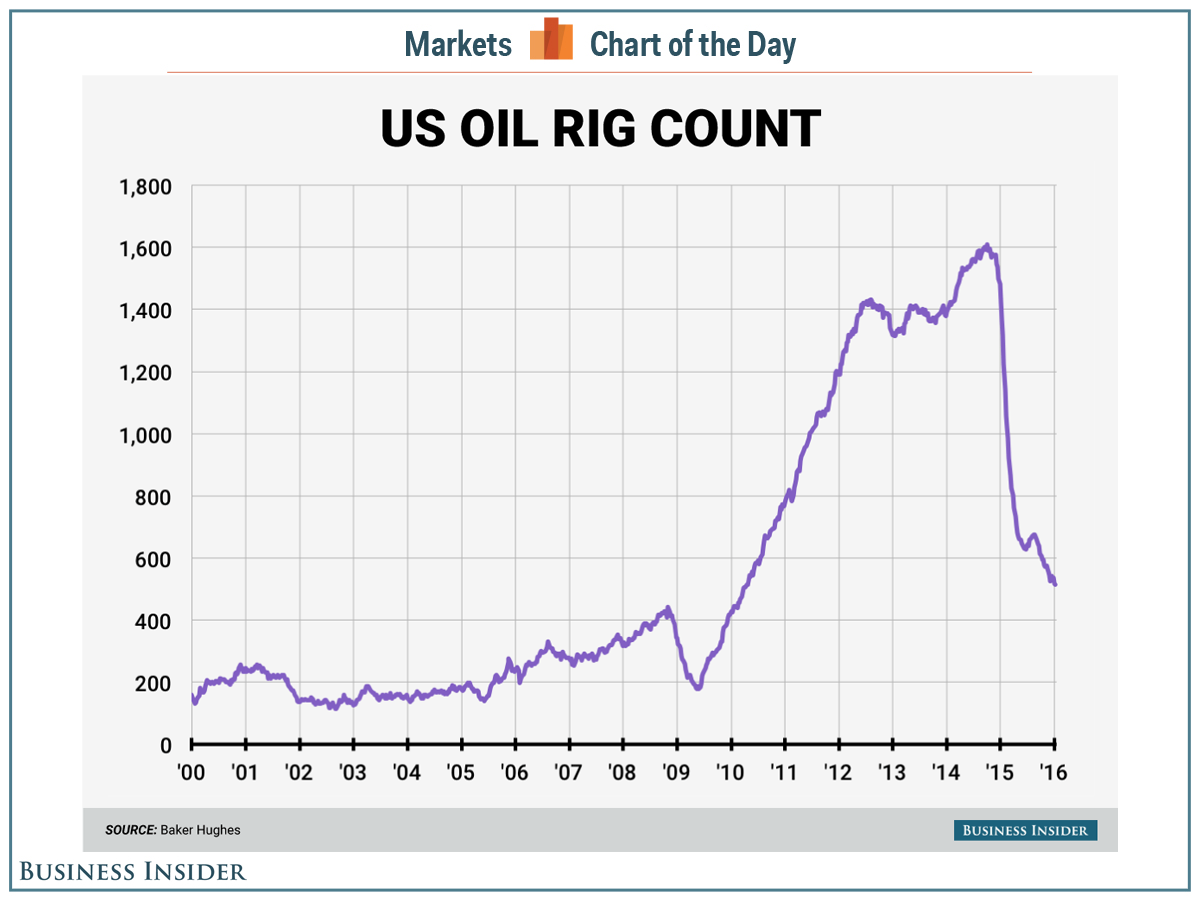

But the number of rigs working in the US hit 1200 in 2012.

That's two long years where fracking is going along while the price of oil isn't affected. Or, if you say fracking was figured out around 2010 (again, see the graph), four years where (a) people knew the number of US land rigs was going to escalate, yet (b) the price of oil didn't do much.

Maybe it's the inflow of Iranian oil? Maybe it's the slowdown in growth in China? Maybe it's solar power? Or maybe it's all these, plus more I don't know about or haven't considered.

Those of us who failed to predict the price of oil would fall in 2008, and those of us who failed to predict it would rise again shortly thereafter, and those of us who failed to predict it would fall again in 2014 are all ill-suited to predict what will happen next.

Why does this matter? If you own an offshore supply vessel, or an offshore rig (or an onshore rig), your utilization is based principally on the price of oil. I could weave a convincing story that there is a hard cap to oil at the marginal price to frack the next barrel. I wouldn't have explained the past, though, so I'm not sure I would use that to explain the future. I cannot imagine the risk taken to put down major capital for a project based on such uncertainty. Thank God for optimism.